***

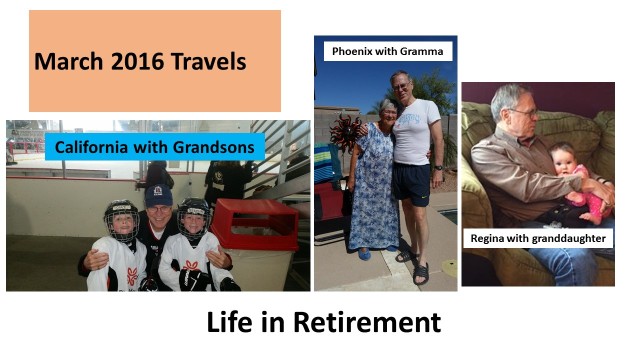

March was a busy month for travel – Phoenix, Regina, California

***

March Results

Finally, a great month. All markets were up between 5 1/2 % to 6 1/4% since my last report. That brings the TSX to a positive 3.72% for the year to date, and the US markets are up 1.5% for the DJIA and almost 0.8% on the S&P on the year.

My portfolio grew by close to 5% in March, stunted a bit by the stronger Canadian dollar, which gained nearly 4% against the US dollar. My Canadian holdings grew by over 5 1/2 % in March and my US holdings were up well over 6%. On a year-to-date basis my portfolio is up almost 4% (nearly 5% on my Canadian and over 6% on my US, less the drop in the US currency).

This again shows that the market does not move up in a smooth regular fashion, but rather in short spurts. As these spurts cannot be predicted, the only way to take advantage is to continually be in the market, not try to time the market.

My net worth has not yet returned to its high in February 2015 when markets were near their peak, however I am within a couple of percentage points and I am at about the same net worth level as the day I retired. I have yet to dip into capital and hope not to have to do so. I have been supporting my lifestyle by dividends only.

***

Interesting Quote

Here is a quote from Rob Carrick’s (Globe and Mail financial reporter) regular update.

A Gen Y personal finance blogger has calculated that you’ll earn roughly $1.8-million in your lifetime if you have a bachelor’s degree. Subtract about $360,000 from that for taxes, and you’re down to something like $1.5-million to pay for everything from houses to kids, cars and food. Good luck with that. Without a plan to control spending and diligently save and invest, you may be doomed to financial futility.

In the introduction to my book “Simple and Successful Investing“, I note that I now have a net worth equal to the sum total of all of my gross earnings since I began working in 1971. Although the above quote is quite disturbing, with a disciplined approach you can overcome the headwinds. Following this blog and reading my book will give you the steps I followed to achieve my financial freedom.

***

My Portfolio

Below are my holdings and their performance for the first three months of the year. Keep in mind that several of my Canadian holdings exist as a result of my fired advisor and I am still working on disposing of these securities. Don’t assume just because I own a security that I recommend buying it. In addition to the below gains and losses, I also have dividends flowing in at an annual rate of almost 4%.

| Canadian Stocks |

|

|

|

US Stocks |

|

|

| Name |

Symbol |

Overall Return |

|

Name |

Symbol |

Overall Return |

| Teck Resources Ltd |

TCK.B |

84.46 |

|

Public Service Enterprise Group Inc. |

PEG |

21.84 |

| TransAlta Corporation |

TA |

23.01 |

|

Verizon Communications Inc. |

VZ |

17.01 |

| Metaux Russel Inc |

RUS |

19.21 |

|

AT&T Inc. |

T |

13.83 |

| Pembina Pipeline Corp |

PPL |

16.45 |

|

Emerson Electric Co. |

EMR |

13.69 |

| Bank of Nova Scotia |

BNS |

14.29 |

|

International Business Machines Corp. |

IBM |

10.07 |

| Husky Energy Inc. |

HSE |

13.00 |

|

The Coca-Cola Co |

KO |

7.96 |

| TransCanada Corporation |

TRP |

12.99 |

|

Chevron Corporation |

CVX |

6.05 |

| Encana Corporation |

ECA |

12.66 |

|

Royal Dutch Shell plc (ADR) |

RDS.A |

5.81 |

| BCE Inc. |

BCE |

10.72 |

|

Kimberly Clark Corp |

KMB |

5.66 |

| ATCO Ltd. |

ACO.X |

10.03 |

|

Johnson & Johnson |

JNJ |

5.33 |

| Enbridge Inc |

ENB |

9.91 |

|

Cisco Systems, Inc. |

CSCO |

4.84 |

| TELUS Corporation |

T |

9.69 |

|

Unilever plc (ADR) |

UL |

4.78 |

| Fortis Inc |

FTS |

8.39 |

|

Procter & Gamble Co |

PG |

3.65 |

| Canadian Imperial Bank of Commerce |

CM |

7.60 |

|

PepsiCo, Inc. |

PEP |

2.56 |

| Shaw Communications Inc |

SJR.B |

5.42 |

|

Lockheed Martin Corporation |

LMT |

2.00 |

| National Bank of Canada |

NA |

5.41 |

|

Merck & Co., Inc. |

MRK |

1.39 |

| Brookfield Infrastructure Partners L.P. |

BIP.UN |

4.41 |

|

Total SA (ADR) |

TOT |

1.05 |

| Great-West Lifeco Inc. |

GWO |

3.67 |

|

Intel Corporation |

INTC |

-6.10 |

| Power Financial Corp |

PWF |

3.63 |

|

Pfizer Inc. |

PFE |

-8.18 |

| Toronto-Dominion Bank |

TD |

3.36 |

|

|

|

|

| Royal Bank of Canada |

RY |

2.02 |

|

Average |

|

5.96 |

| Suncor Energy Inc. |

SU |

1.26 |

|

Weighted Average |

|

6.05 |

| Bank of Montreal |

BMO |

1.01 |

|

|

|

|

| BCE INC. PREFERRED SHARES SERIES AD |

BCE-D |

1.00 |

|

|

|

|

| Claymore 1-5 Yr Laddered Corporation Bond Exchange Traded Fund |

CBO |

-0.16 |

|

|

|

|

| Sun Life Financial Inc |

SLF |

-2.90 |

|

|

|

|

| Cenovus Energy Inc |

CVE |

-3.43 |

|

|

|

|

| Potash Corporation of Saskatchewan Inc |

POT |

-6.71 |

|

|

|

|

| Agrium Inc. |

AGU |

-7.28 |

|

|

|

|

| Enbridge Inc (pref shares) |

ENB-B |

-11.18 |

|

|

|

|

| Manulife Financial Corp. |

MFC |

-11.38 |

|

|

|

|

|

|

|

|

|

|

|

| Simple Average |

|

7.76 |

|

|

|

|

| Weighted Average |

|

4.87 |

|

|

|

|

***

***

Suggested stocks (A++, 2% yield or more, 10 year dividend growth)

Note: some stocks do not screen in on ValueLine for a variety of reasons. If a stock you are interested in or own, is not on the list, let me know and I can forward you an evaluation of that company.

US

| Company |

Ticker |

Financial Strength |

Dividend Yield |

Dividend Growth 10-Year |

Current PE Ratio |

| 3M Company |

MMM |

A++ |

2.7 |

7.5 |

20.53 |

| Abbott Labs. |

ABT |

A++ |

2.55 |

1.5 |

19.22 |

| AT&T Inc. |

T |

A++ |

4.96 |

3.5 |

13.94 |

| Automatic Data Proc. |

ADP |

A++ |

2.59 |

13 |

26.26 |

| Boeing |

BA |

A++ |

3.39 |

12.5 |

16.6 |

| Bristol-Myers Squibb |

BMY |

A++ |

2.43 |

2.5 |

32.91 |

| Cardinal Health |

CAH |

A++ |

2.15 |

26 |

17.91 |

| Chevron Corp. |

CVX |

A++ |

4.51 |

10.5 |

|

| Coca-Cola |

KO |

A++ |

3.07 |

9.5 |

23.62 |

| Colgate-Palmolive |

CL |

A++ |

2.26 |

11 |

46.61 |

| Deere & Co. |

DE |

A++ |

2.99 |

15.5 |

18.88 |

| Dover Corp. |

DOV |

A++ |

2.6 |

9.5 |

17.42 |

| Du Pont |

DD |

A++ |

2.47 |

2.5 |

20.83 |

| Emerson Electric |

EMR |

A++ |

3.49 |

8 |

17.55 |

| Exxon Mobil Corp. |

XOM |

A++ |

3.49 |

9.5 |

31.45 |

| Gen’l Dynamics |

GD |

A++ |

2.36 |

13.5 |

13.9 |

| Grainger (W.W.) |

GWW |

A++ |

2.04 |

17.5 |

19.44 |

| Home Depot |

HD |

A++ |

2.12 |

19 |

21.67 |

| Honeywell Int’l |

HON |

A++ |

2.14 |

9.5 |

17.31 |

| Illinois Tool Works |

ITW |

A++ |

2.17 |

12 |

19.02 |

| Int’l Business Mach. |

IBM |

A++ |

3.65 |

20 |

11.89 |

| Intel Corp. |

INTC |

A++ |

3.26 |

23.5 |

13.01 |

| Johnson & Johnson |

JNJ |

A++ |

2.95 |

10.5 |

18.84 |

| Kimberly-Clark |

KMB |

A++ |

2.76 |

8 |

29.61 |

| Lilly (Eli) |

LLY |

A++ |

2.87 |

3.5 |

20.98 |

| Lockheed Martin |

LMT |

A++ |

3.1 |

20.5 |

18.86 |

| McDonald’s Corp. |

MCD |

A++ |

2.92 |

23 |

23.13 |

| Medtronic plc |

MDT |

A++ |

2.14 |

15 |

14.01 |

| Merck & Co. |

MRK |

A++ |

3.47 |

1.5 |

14.34 |

| Microsoft Corp. |

MSFT |

A++ |

2.66 |

19 |

19.29 |

| Novartis AG ADR |

NVS |

A++ |

3.63 |

14.5 |

18.6 |

| PepsiCo, Inc. |

PEP |

A++ |

2.85 |

12.5 |

20.93 |

| Pfizer, Inc. |

PFE |

A++ |

3.99 |

4.5 |

19.92 |

| Procter & Gamble |

PG |

A++ |

3.2 |

10 |

20.62 |

| Public Serv. Enterprise |

PEG |

A++ |

3.56 |

3 |

16.04 |

| Qualcomm Inc. |

QCOM |

A++ |

3.78 |

22.5 |

12.56 |

| Raytheon Co. |

RTN |

A++ |

2.38 |

11.5 |

17.44 |

| Schlumberger Ltd. |

SLB |

A++ |

2.76 |

13.5 |

|

| Smucker (J.M.) |

SJM |

A++ |

2.13 |

9.5 |

21.67 |

| Texas Instruments |

TXN |

A++ |

2.68 |

29.5 |

19.22 |

| Total ADR |

TOT |

A++ |

6.1 |

8 |

29.4 |

| Travelers Cos. |

TRV |

A++ |

2.12 |

6 |

11.48 |

| Unilever PLC ADR |

UL |

A++ |

3.09 |

6.5 |

22.54 |

| Union Pacific |

UNP |

A++ |

2.72 |

21 |

15.53 |

| United Technologies |

UTX |

A++ |

2.58 |

14 |

15.6 |

| Verizon Communic. |

VZ |

A++ |

4.22 |

3 |

13.42 |

| Wal-Mart Stores |

WMT |

A++ |

2.94 |

16.5 |

16.35 |

Canada (includes A++, A+, A, B++, B+)

| Company |

Ticker |

Domicile Code |

Financial Strength |

Dividend Yield |

Dividend Growth 10-Year |

Current PE Ratio |

| Agrium, Inc. |

AGU |

CA |

A |

4.02 |

39 |

11.41 |

| Bank of Montreal |

BMO.TO |

CA |

B++ |

4.41 |

7 |

11.23 |

| Bank of Nova Scotia |

BNS.TO |

CA |

A |

4.68 |

9 |

10.58 |

| BCE Inc. |

BCE |

CA |

B++ |

4.4 |

9.5 |

21.14 |

| CAE Inc. |

CAE.TO |

CA |

B+ |

2.01 |

6.5 |

16.25 |

| Cameco Corp. |

CCO.TO |

CA |

B+ |

2.38 |

15.5 |

12.03 |

| Can. Imperial Bank |

CM.TO |

CA |

A+ |

4.93 |

6.5 |

10.09 |

| Can. Natural Res. |

CNQ.TO |

CA |

B++ |

2.67 |

23.5 |

|

| Enbridge Inc. |

ENB.TO |

CA |

B++ |

4.28 |

11.5 |

20.65 |

| Fortis Inc. |

FTS.TO |

CA |

B+ |

3.76 |

9 |

19 |

| Jean Coutu Group |

PJC/A.TO |

CA |

B++ |

2.09 |

10.5 |

16.85 |

| Magna Int’l ‘A’ |

MGA |

CA |

A |

2.42 |

7.5 |

8.42 |

| Manitoba Telecom Svcs. |

MBT.TO |

CA |

B+ |

4.05 |

3.5 |

26.77 |

| Manulife Fin’l |

MFC |

CA |

B++ |

3.81 |

5.5 |

10.55 |

| Methanex Corp. |

MEOH |

CA |

B+ |

3.41 |

23 |

78.59 |

| Nat’l Bank of Canada |

NA.TO |

CA |

B++ |

5.39 |

10.5 |

9.04 |

| Pembina Pipeline Corp. |

PPL.TO |

CA |

B++ |

5.52 |

4.5 |

27.63 |

| Potash Corp. |

POT |

CA |

B++ |

5.86 |

34.5 |

15.96 |

| Power Financial |

PWF.TO |

CA |

B+ |

4.66 |

8.5 |

9.99 |

| Rogers Communications |

RCIB.TO |

CA |

B+ |

3.73 |

51.5 |

18.59 |

| Royal Bank of Canada |

RY.TO |

CA |

A |

4.52 |

10.5 |

10.78 |

| Russel Metals |

RUS.TO |

CA |

B++ |

7.89 |

16 |

20.06 |

| Shaw Commun. ‘B’ |

SJRB.TO |

CA |

B+ |

4.81 |

28.5 |

13.86 |

| SNC-Lavalin Group |

SNC.TO |

CA |

B++ |

2.26 |

20 |

18.52 |

| Suncor Energy |

SU.TO |

CA |

A |

3.24 |

24 |

|

| TELUS Corporation |

T.TO |

CA |

B++ |

4.42 |

15.5 |

17.07 |

| Thomson Reuters |

TRI.TO |

CA |

B++ |

2.61 |

6 |

22.67 |

| Toronto-Dominion |

TD.TO |

CA |

B++ |

3.98 |

10.5 |

12.32 |

| TransCanada Corp. |

TRP |

CA |

B++ |

5.98 |

5.5 |

|

Europe (includes A++, A+, A, B++, B+)

| Company |

Ticker |

Domicile Code |

Financial Strength |

Dividend Yield |

Dividend Growth 10-Year |

Current PE Ratio |

| Novartis AG ADR |

NVS |

CH |

A++ |

3.63 |

14.5 |

18.6 |

| Daimler AG |

DDAIF |

DE |

B++ |

6.09 |

6 |

8.42 |

| Siemens AG (ADS) |

SIEGY |

DE |

A |

3.84 |

13.5 |

11.09 |

| Total ADR |

TOT |

FR |

A++ |

6.1 |

8 |

29.4 |

| AstraZeneca PLC (ADS) |

AZN |

GB |

B++ |

5 |

13.5 |

20.14 |

| Brit. Amer Tobac. ADR |

BTI |

GB |

B++ |

4.01 |

14.5 |

16.55 |

| BT Group ADR |

BT |

GB |

B++ |

3.53 |

2.5 |

12.18 |

| GlaxoSmithKline ADR |

GSK |

GB |

A+ |

5.87 |

7 |

20.93 |

| Rio Tinto plc |

RIO |

GB |

A |

3.97 |

10.5 |

9.06 |

| Vodafone Group ADR |

VOD |

GB |

B++ |

5.59 |

14 |

35.98 |

| WPP PLC ADR |

WPPGY |

GB |

A |

3.12 |

17.5 |

15.85 |

| Tenaris S.A. ADS |

TS |

LU |

B+ |

3.75 |

16.5 |

53.29 |

| Philips Electronics NV |

PHG |

NL |

B+ |

3.45 |

10 |

25.27 |

| Unilever PLC ADR |

UL |

NL |

A++ |

3.09 |

6.5 |

22.54 |

***

About borgford

Feel free to contact me with questions: brianborgford@hotmail.com

March 2016 Update

***

March was a busy month for travel – Phoenix, Regina, California

***

March Results

Finally, a great month. All markets were up between 5 1/2 % to 6 1/4% since my last report. That brings the TSX to a positive 3.72% for the year to date, and the US markets are up 1.5% for the DJIA and almost 0.8% on the S&P on the year.

My portfolio grew by close to 5% in March, stunted a bit by the stronger Canadian dollar, which gained nearly 4% against the US dollar. My Canadian holdings grew by over 5 1/2 % in March and my US holdings were up well over 6%. On a year-to-date basis my portfolio is up almost 4% (nearly 5% on my Canadian and over 6% on my US, less the drop in the US currency).

This again shows that the market does not move up in a smooth regular fashion, but rather in short spurts. As these spurts cannot be predicted, the only way to take advantage is to continually be in the market, not try to time the market.

My net worth has not yet returned to its high in February 2015 when markets were near their peak, however I am within a couple of percentage points and I am at about the same net worth level as the day I retired. I have yet to dip into capital and hope not to have to do so. I have been supporting my lifestyle by dividends only.

***

Interesting Quote

Here is a quote from Rob Carrick’s (Globe and Mail financial reporter) regular update.

A Gen Y personal finance blogger has calculated that you’ll earn roughly $1.8-million in your lifetime if you have a bachelor’s degree. Subtract about $360,000 from that for taxes, and you’re down to something like $1.5-million to pay for everything from houses to kids, cars and food. Good luck with that. Without a plan to control spending and diligently save and invest, you may be doomed to financial futility.

In the introduction to my book “Simple and Successful Investing“, I note that I now have a net worth equal to the sum total of all of my gross earnings since I began working in 1971. Although the above quote is quite disturbing, with a disciplined approach you can overcome the headwinds. Following this blog and reading my book will give you the steps I followed to achieve my financial freedom.

***

My Portfolio

Below are my holdings and their performance for the first three months of the year. Keep in mind that several of my Canadian holdings exist as a result of my fired advisor and I am still working on disposing of these securities. Don’t assume just because I own a security that I recommend buying it. In addition to the below gains and losses, I also have dividends flowing in at an annual rate of almost 4%.

***

***

Suggested stocks (A++, 2% yield or more, 10 year dividend growth)

Note: some stocks do not screen in on ValueLine for a variety of reasons. If a stock you are interested in or own, is not on the list, let me know and I can forward you an evaluation of that company.

US

Canada (includes A++, A+, A, B++, B+)

Europe (includes A++, A+, A, B++, B+)

***

Share this:

Related

About borgford

Feel free to contact me with questions: brianborgford@hotmail.com